Not Everyone Is Scared by Inflation Spike

From Wall Street to the C-Suite to the White House, inflation worries are brewing across America

Perhaps with good reason. Wednesday brought news that the consumer price index had jumped the most since 2009 in April.

For now, though, officials at the Federal Reserve are holding their line that the recent acceleration in price pressures will prove transitory. That means they can maintain their ultra-easy monetary policy in the hope it helps boost demand and hiring.

Heating Up

U.S. core and headline inflation both jumped more than forecast in April

Source: Bureau of Labor Statistics

So, why the confidence as prices from lumber to gasoline to used cars surge?

Interviews and a review of Fed speeches leads Steve Matthews to reckon there are six reasons:

- Inflation expectations are under control

- There remains slack in the labor force with wage gains limited

- An Atlanta Fed index of sticky prices is rising less than one for flexible prices

- Many U.S. firms remain reluctant to raise prices on their goods

- Technological advances and globalization will keep a cap on prices

- So-called base effects mean prices were always going to jump after falling so much last year

Record Rise

Travel and leisure categories post record increases amid reopening

Source: Bureau of Labor Statistics

Note: Represents percent change between March and April 2021

“The case is really quite strong for the outlook for inflation being quite moderate,” said David Wilcox, a former head of the Fed’s research and statistics division and now a senior fellow at the Peterson Institute for International Economics. “The basic strategy is exactly the right one, which is to project a realistic confidence about the outlook for inflation, combined with a readiness to pivot if circumstances change.”

Still, Atlanta Fed President Raphael Bostic expects volatile readings through September, and White House aides are braced for price pressures through year-end, Nancy Cook reports, while Payne Lubbers looks at how long prices may stay elevated.

Fed Isn’t Freaking Out About Inflation

If inflation keeps racing higher — and more on that score is due Thursday, with producer prices data — then the Fed’s bet will face a sterner test.

—Chris Anstey and Simon Kennedy

- Got tips or feedback? Email us at ecodaily@bloomberg.net

- Check out the latest Stephanomics podcast

The Economic Scene

Sending Money Home

Remittance flows held up overall in 2020, but regional disparities emerged

Source: World Bank

Global remittances showed surprising strength in 2020 despite dire projections, as heavy government stimulus spending put cash in immigrants’ pockets to send home.

In April last year, the World Bank projected a 20% fall in remittances, but ultimately they dropped just 1.6% — or $8 billion — to $540 billion, according to a report published Wednesday. By comparison, such payments fell 4.8% in the 2009 global financial crisis.

Today’s Must Reads

- Canadians concerned. Canadians are so alarmed by the red-hot housing market that many say they’d like to see the central bank raise the cost of borrowing to stabilize prices, a survey showed.

- Test for economists. About 40% of the $2.25 trillion American Jobs Plan that President Joe Biden introduced in March consists of infrastructure pertaining to people. More used to hard infrastructure, economists are struggling to forecast the likely economic boost.

- Latin American interest rates. The central banks of Mexico, Chile and Peru are expected to leave their key rates unchanged on Thursday even as inflation picks up.

- ECB laggards. Members of the ECB’s Governing Council and Supervisory Board keep nearly half of their private investments in assets that rank “average” or “laggard” on an MSCI scale of sustainability, according to an analysis by Bloomberg of publicly available declarations of interest.

- Chip king. South Korea unveiled plans to spend roughly $450 billion to build the world’s biggest chipmaking base over the next decade, joining China and the U.S. in a global race to dominate the key technology.

- Tax backlash. Colombia’s botched attempt at raising taxes is teaching a lesson to fellow Latin American nations on how not to rush to rein in widening budget deficits.

Need-to-Know Research

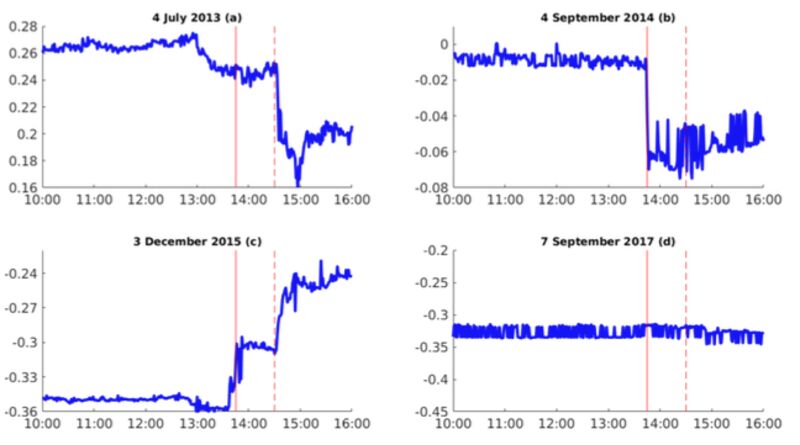

Are central bankers talking too much? In research detailed this week on VoxEU, economists Carlo Altavilla, Refet Gürkaynak, Roberto Motto and Giuseppe Ragusa probe the effect speeches by policy makers have on corporate executives. Assessing 61 countries from 1998 to 2016, the authors said the more business leaders hear, the smaller the effect on the economy they attribute to their central banks.

“While important for informing managers about central bank policies, there may be too many speeches, especially from board members other than governors,” the study said. “Governors provide a consistent message over time, whereas other board members are more likely to convey diverging messages that confuse the receivers.”

On #EconTwitter

Fed Isn’t Freaking Out About Inflation

What would be the effect if we all did less commuting?